water damage (along with damage from freezing) is the third most costly type of home insurance claim and makes up almost 20% of home insurance property damage claims, according to the Insurance Information Institute. The average insurance claim for water…

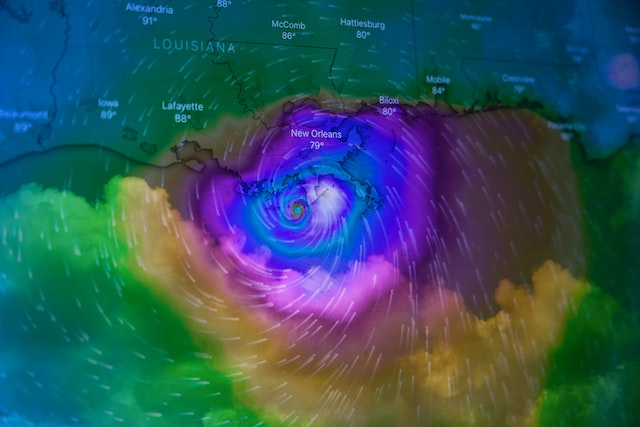

Floods are often the most damaging part of a hurricane. If your property is located in a high-risk flood area, your mortgage lender might even require that you purchase flood insurance. There are two sources for flood insurance: The majority…

If you live in a region that gets hurricanes, you’ll want to make sure you have the right combination of insurance policies to cover damage. In many coastal areas, a standard homeowners insurance policy won’t help with any hurricane damage.…

Generally, both the terms “mobile home” and “manufactured home” refer to factory-built home. The biggest difference is the name itself. A factory-built home prior to June 15, 1976, is a mobile home and one built after that date is considered…

A typical mobile home insurance policy covers your home and personal belongings, and pays for medical expenses if someone is hurt on your property. Because mobile and manufactured homes are different from traditional houses, a standard home insurance policy won’t…

“Loss of use” coverage is also known as “additional living expenses” coverage, or ALE. Loss of use insurance is valuable if you can’t live at home because of damage that’s covered by the policy. You can make claims for the…

When you buy home insurance, you’ll likely have a choice between “replacement cost” and “actual cash value” coverage. Replacement cost is more expensive because it pays more in the event of a claim. It will reimburse you for new items…