You should buy life insurance at the youngest age when you have a need for it. This could be when you get married, buy a house or have a baby. These life events often mean that someone else relies on…

For a male age 30, the average life insurance cost per month is $27.25 for a $1 million, 10-year term life insurance policy. For a 30-year-old woman, the average monthly price is $22.83 for the same policy. At age 40,…

Accidental death and dismemberment (AD&D) insurance pays out if you die due to an accident (like a car crash) or if you become paralyzed or lose a limb, hearing, sight or speech. AD&D does not pay out if you die…

Guaranteed universal life (GUL) insurance can last as long as you live, assuming you make the payments on time. The death benefit amount for your beneficiaries is guaranteed and your premiums don’t change. It’s the cheapest way to buy life…

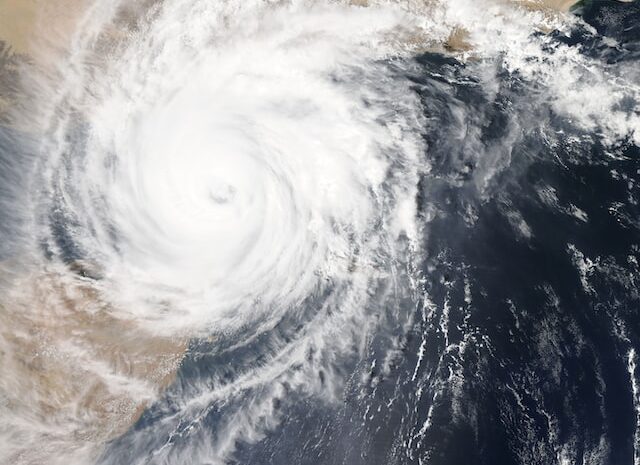

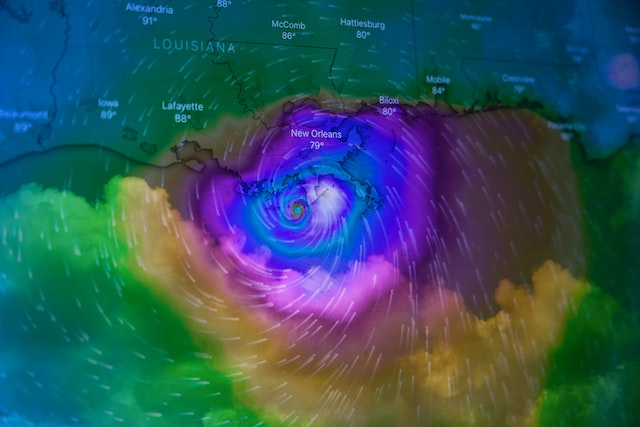

Floods are often the most damaging part of a hurricane. If your property is located in a high-risk flood area, your mortgage lender might even require that you purchase flood insurance. There are two sources for flood insurance: The majority…

A deductible is the amount subtracted from an insurance claims check. Hurricane insurance deductibles are often set as a percentage of the dwelling coverage. These percentages typically vary from 1% to 5%, according to the Insurance Information Institute. A common…

In some coastal areas, homeowners are unable to buy coverage for wind damage because of their high chance of making claims. They often have to turn to “last resort” coverage.

If you live in a region that gets hurricanes, you’ll want to make sure you have the right combination of insurance policies to cover damage. In many coastal areas, a standard homeowners insurance policy won’t help with any hurricane damage.…