Guaranteed universal life (GUL) insurance can last as long as you live, assuming you make the payments on time. The death benefit amount for your beneficiaries is guaranteed and your premiums don’t change. It’s the cheapest way to buy life…

water damage (along with damage from freezing) is the third most costly type of home insurance claim and makes up almost 20% of home insurance property damage claims, according to the Insurance Information Institute. The average insurance claim for water…

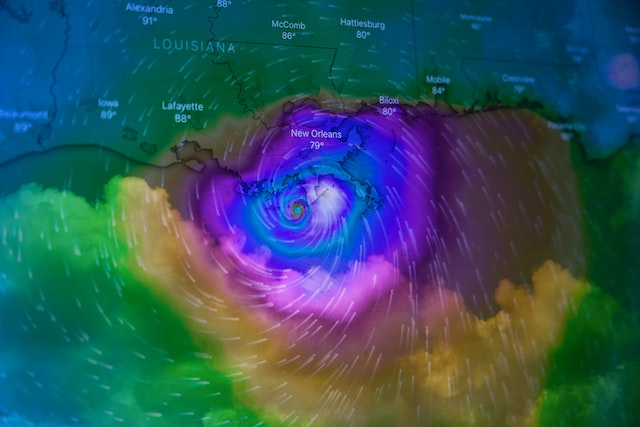

In some coastal areas, homeowners are unable to buy coverage for wind damage because of their high chance of making claims. They often have to turn to “last resort” coverage.

If you live in a region that gets hurricanes, you’ll want to make sure you have the right combination of insurance policies to cover damage. In many coastal areas, a standard homeowners insurance policy won’t help with any hurricane damage.…

Homeowners insurance does not generally cover earthquake damage, so you’ll need a separate earthquake insurance policy. What’s typically covered by earthquake insurance:The dwelling (house).Other structures.Personal property.Loss of use, meaning extra expenses you have if you can’t live at home due…

Generally, both the terms “mobile home” and “manufactured home” refer to factory-built home. The biggest difference is the name itself. A factory-built home prior to June 15, 1976, is a mobile home and one built after that date is considered…

A typical mobile home insurance policy covers your home and personal belongings, and pays for medical expenses if someone is hurt on your property. Because mobile and manufactured homes are different from traditional houses, a standard home insurance policy won’t…