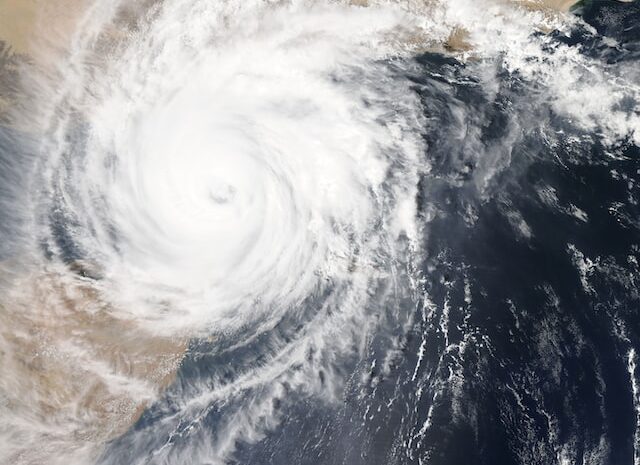

What is a normal hurricane deductible?

A deductible is the amount subtracted from an insurance claims check.

Hurricane insurance deductibles are often set as a percentage of the dwelling coverage. These percentages typically vary from 1% to 5%, according to the Insurance Information Institute. A common hurricane deductible is 2%. In Florida, homeowners could have hurricane deductibles as high as 10%.

If you have wind coverage through a standard homeowners insurance policy, there are generally two types of deductibles.

- Hurricane deductibles apply only to claims for wind damage from hurricanes.

- Windstorm or wind/hail deductibles apply to claims from any other type of storm with wind or hail.

To decide whether a storm is an actual “hurricane,” your insurance company likely relies on the National Weather Service to officially “name” a storm (such as “Hurricane Harvey”), declare a watch or warning, or define a storm’s intensity by its wind speed, according to the Insurance Information Institute.